Engaging Brands: New Transactions

Part one in Dalziel & Pow's Engaging Spaces series looks at new transactions brands are exploring to capture consumer attention. Read the full piece here.

Part one in Dalziel & Pow's Engaging Spaces series looks at new transactions brands are exploring to capture consumer attention. Read the full piece here.

The first instalment of our Engaging Brands series explores how payment itself is becoming a frontier for imaginative customer engagement and the options for brands are diversifying. Payment is one of the primary ways in which consumers and brands engage with one another. The developing customer expectation for new transactions has made this a subject of interest within our wider Engaging Brands thinking, from immediacy to new currencies to social selling.

The way in which consumers are paying for goods and services has evolved dramatically in recent years and shows no sign of slowing down; brands are exploring new transactions to capture consumer attention and stay ahead of competitors. With this in mind, it’s hard to imagine the impact that Bitcoin has had on payment and transactions since its birth in 2009, opening doors for new currencies and boosting digital payments. Bitcoin, backed entirely by cryptic algorithms, changed the way modern consumers consider money; ‘money’ in Bitcoin’s case moved from being considered solely as a standard physical commodity exchanged for goods and services, to a decentralised public system of peer-to-peer collaboration.

Consumers gravitate to convenience, driven by real-time social media feeds, location-based marketing, and innovative on-demand brands such as Netflix and Uber infiltrating the market. The rapid growth of mobile payments from Apple, Google and recently Samsung, combined with reports stating that one in five people expect to be using fingerprint technology to pay in the next five years*, fuels the demand for faster, more convenient ways to check out within retail.

Amazon redefined ‘one-click buying’ with the launch of its Dash Replenishment Service (DRS) earlier this year, allowing customers to re-order products via a physical button in their house. Now, going one step further, Amazon has partnered with General Electric, Samsung and a number of smart device manufacturers to install a new Dash programme into smart products such as washing machines. Built-in sensors automatically re-order items, such as laundry detergent, through customers’ Amazon accounts.

Visa’s innovation hub collaborated with fashion designer Henry Holland to create a future payment initiative called the ‘Cashless Catwalk’ at London Fashion Week. Front-row celebrities were invited onto the catwalk to ‘buy’ items during the finale – holding personal NFC (near-field communication) enamel rings against S/S 2016 garments tagged with a reader brooch. This gesture instantly transferred payment, demonstrating a fun and simple way for brands to engage customers with real-time transactions.

Similar to Henry Holland’s cashless catwalk rings, Topshop is introducing contactless payment accessories to the masses with help from bPay by Barclaycard. The accessories range will consist of smartphone cases, wristbands, key chains and stickers linked to users’ bPay digital wallets, and will be launched in store and online in November 2015.

Health and wellbeing are hot topics within retail and technology, driven by consumers’ increased interest in food, fitness and holistic lifestyles. This well-educated consumer measures everything, from how steep their walk to work is, to the nutritional value of their lunch, resulting in an exponential growth in brand engagement through gamification and experiential retail.

US company Wellcoin, ‘the world’s first healthy currency’, allows consumers to earn virtual ‘wellcoins’ in exchange for taking part in healthy activities, such as choosing a healthy beverage or getting at least seven hours sleep each night. These coins can be redeemed within Wellcoin’s marketplace of brands, which includes Whole Foods, Reebok and Puma, where consumers can buy gym classes, healthy food and workout gear.

Similar to Wellcoin, there are now a couple of brands converting consumers’ fitness engagement into ‘real’ money. Fitcoin is a new app that syncs with a wearable to measure workout variables, such as intensity, distance and heart rate, and converts the consumer’s effort into bitcoins. And Russian bank Alfa-Bank launched a new financially rewarding programme, allowing customers’ savings to be transferred into a special high-interest account when engaging in an active lifestyle monitored by a fitness wearable.

Sports and outdoor retailers have taken a more experiential and reactive approach to new transactions. Nike Fuel vending machines appeared around New York in summer 2014, allowing customers to pay for branded accessories with the Nike FuelBand points they clocked up whilst working out.

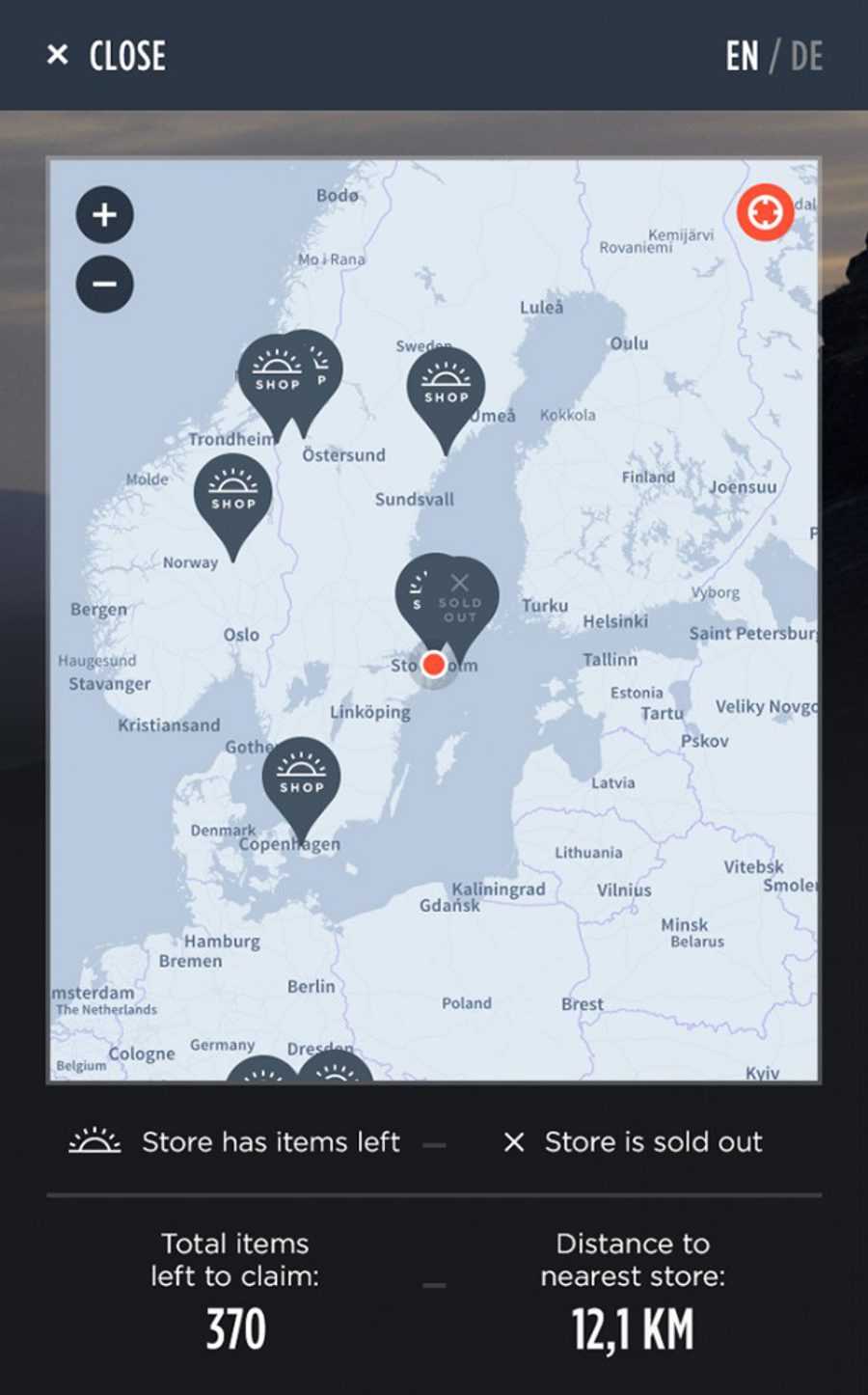

And more recently, Swedish outdoor brand Peak Performance launched Magic Hour – virtual pop-ups in rural locations of exceptional beauty, offering free stock accessible via mobile in the first and last hour of sunlight.

Savvy brands have been harnessing social media for years, engaging consumers in conversation, tapping into user-generated content and progressing from simple sales-prompting images to click-to-buy visuals. According to Stylus, “social media has long been an inspiration platform, but the wider integration of ways to buy instantly in-app will mark a key turning point in e-commerce”, presenting brands with an opportunity to immediately engage consumers once inspired by fan and brand-generated content.

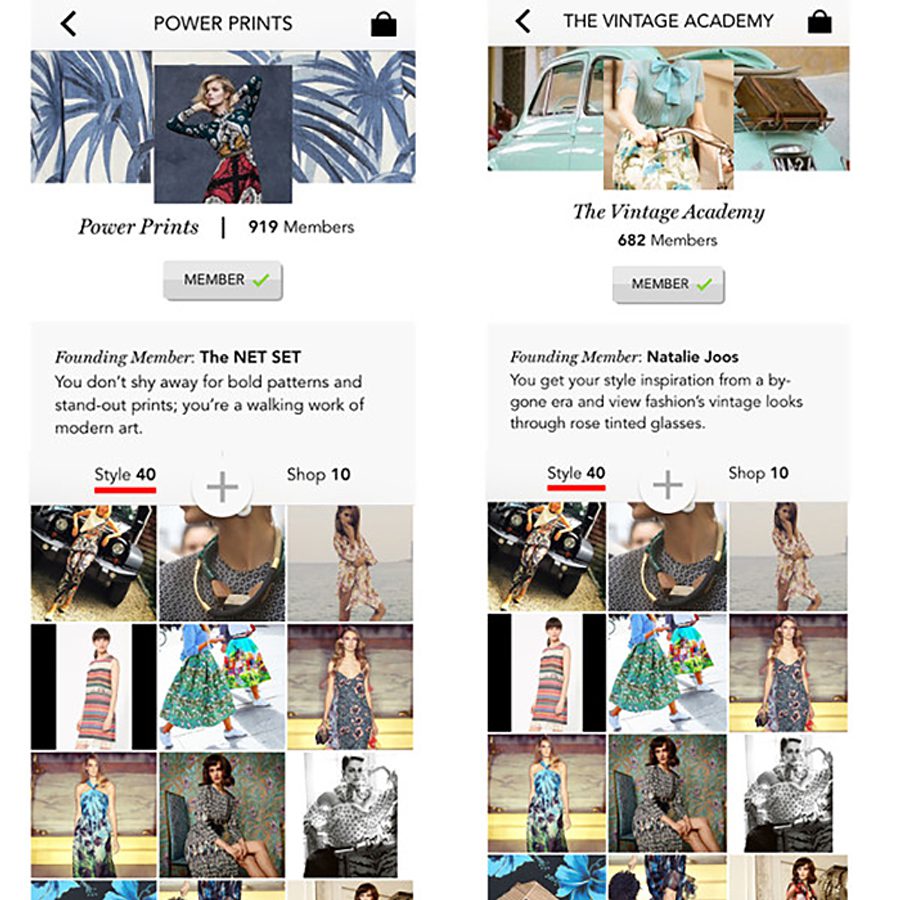

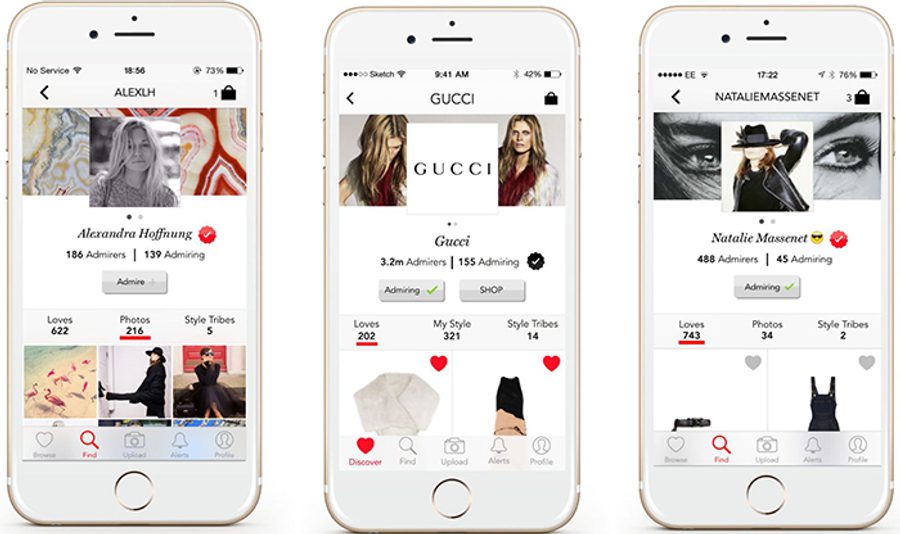

Outwith Pinterest, Facebook and Instagram’s buy buttons, one of the most interesting developments in social selling came from multi-brand luxury e-tailer Net-A-Porter. The Net Set is an ultra visual shoppable social network that invites users to create a profile and follow other shoppers, brands and high-profile fashion influencers. The platform’s two points of difference are the open style tribes, such as ‘Downtown Girls’ and ‘The Bohemians’, which is made up of holistic style photos (users can submit their own too) and affiliated products available to buy. The second is the image-recognition feature that allows users to upload photos and instantly match items with the retailer’s product inventory, available for instant purchase.

The potential for brands to experiment with new transactions is enormous, whether through new technological developments to create the slickest and quickest transactions, capturing and rewarding consumers’ attention in a relevant way, or encouraging collaboration through social tools.

We believe that new transactions are an essential part of engaging brands in the future. As technology and consumer appetite for new experiences evolve, transactions need to reflect this, incorporating the magic and immersion that consumers desire.

*Research from Lloyds Bank UK on the future of payments.

Introduction: What Makes an Engaging Brand?

New Transactions

The Human Touch

Time Well Spent

Always with You

Brands Behaving Differently

If you’d like to discuss these themes further, please do get in touch.