You should get ready for a C-Beauty brand invasion

Outside of its home market, not many people know much about the Chinese beauty scene. That’s about to change. Written by Design Project Leader, Myree Tydings.

Outside of its home market, not many people know much about the Chinese beauty scene. That’s about to change. Written by Design Project Leader, Myree Tydings.

If you’re in the beauty industry, or simply love anything beauty related, you’ll surely be familiar with the terms J-Beauty and K-Beauty. Japanese and Korean beauty have carved out quite a niche for themselves internationally, creating unique cult products (think Korean sheet masks and Japanese oil cleansers), paving the way for a flurry of other brands and products to flood the international market. J-Beauty has been around for much longer and focuses on simplicity, prevention, and hydration. K-beauty has dominated more recently with quirky trend driven products that offer instant gratification and results.

International brands have relied on Chinese tourism as a big percentage of their sales, particularly in Asia. More recently, a shift directly into the mammoth, ever-growing Chinese market is a coveted business goal of many brands. The Chinese have typically relied on international brands at the mid and premium market levels, but local brands are now learning and developing, taking back a portion of the market share.

Enter stage left, C-Beauty.

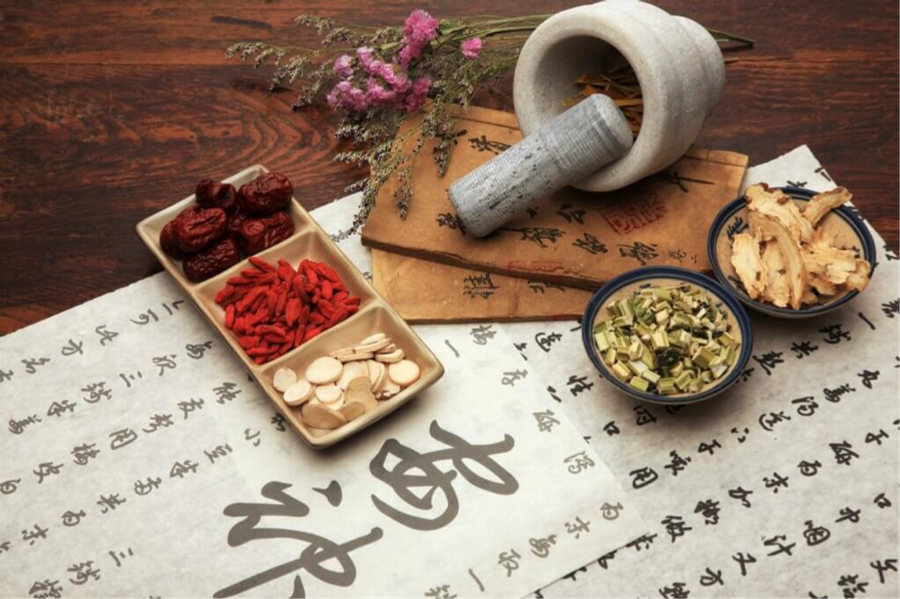

A significant number are going back to their herbal roots and harnessing more than 2000 years worth of history with Traditional Chinese Medicine… with a twist of modern science. This is particularly appealing in a time where ‘wellness’ is directly equated to beauty. Going back to your roots, with natural and proven ingredients that treat you inside and out.

“Traditional Chinese herbs were originally used by ancient Chinese doctors as medicine to treat illness, now its benefits and effects are valued scientifically worldwide. Comparatively, Chinese herbs have had a much longer history when it comes to being used on the human body, and their functionality and safety have been testified long ago,” says WEI founder and CEO, Wei Young Brian.

So what is driving the C-Beauty expansion?

In the article ‘Cosmetics In China: Top Brand Marketing Strategies To Unlock The Beauty Market’, Oliver Verot suggests that for the Chinese beauty customer, typically until now, French & European beauty brands have been perceived as innovative and exclusive. Japanese brands also have hovered at the premium end of the scale, whilst Korean, Asian and US brands have more a mass market positioning.

Social status is very important, and using luxury brands is their way of showing status and affluence. There is a mentality that the more expensive it is, the better it must be. Also, Chinese Gen Z is starting skincare earlier than before, and a lot of these young customers are after anti-ageing products that tend to be more expensive.

Having said that, Chinese customers usually have no brand loyalty. Perceived value is put above everything else and brand image can only go so far in creating that, and ultimately consumer reviews and feedback have a strong effect on purchasing decisions. Extensive product research is generally conducted before purchase (via different e-commerce channels, bloggers, WeChat, trendsetters and influencers and social platforms. (Source: Marketing to China Cosmetics In China: Top Marketing Strategies To Succeed In The Beauty Market June 24, 2018 | Beauty, Cosmetic China)

Chinese brands are now learning and adapting very quickly to the unique Chinese customer beauty needs. Simply by speaking the language and understanding customer behaviours, they are at an automatic advantage. Brands like Wei and Herborist are challenging the long-held positions of some of the premium international beauty brands. Pechoin and Inoherb are helping lead the Chinese beauty expansion at the more affordable mass-market end of the scale.

Pechoin in particular has been the top-selling skincare brand in China for two consecutive years and is the only beauty brand in China to exceed 100 million consumer purchases. (Source: Kantar Worldpanel ‘China’s beauty market is seeing rapid growth’)

As suggested by Natasha Spencer in her article ‘C-Beauty is on its Way’, one problem with expansion is the practicality of the physical vastness of the country. Lower tier cities (still with large populations) are not as accessible, and therefore local brands have a much better chance of reaching these areas and customers, more so than international brands that need to largely rely on bigger wealthy cities and department stores for distribution.

To facilitate expansion in China, having the means to harness local Chinese celebrities for endorsements etc, allows for huge media exposure and the crucial Gen Z and Millennial engagement.

There is also a strong drive for product safety after many recent food and product scandals. Going for local brands and ingredients that are known and trusted, and which are considered natural and clean is becoming more and more appealing to the Chinese customer. Being able to trace the product provenance and know that it’s legitimate is of the utmost importance.

Speaking of natural and clean, with China’s significant air pollution problem, there’s understandably a push for skincare that helps combat ‘polluaging’. Practitioners of Traditional Chinese Medicine firmly believe that wellness and beauty are linked. “Our products go beyond beautifying the skin—they help it become more resilient against environmental stressors and pollution.” (Source: Ervina Wu, co-founder of 5YINA)

China’s beauty market is predicted to grow to nearly $62 billion by 2020

Due to the rise of the Chinese middle class, it’s fast becoming the largest beauty market in the world and local brands are wising up to this. China’s retail sales in beauty stands at $53 billion and the beauty market is predicted to grow to nearly $62 billion by 2020. Dominance of this massive market is a fierce competition, and with its success would come inevitable global expansion for C-Beauty. (Source: Global Cosmetic Industry 2018)

How will it affect the international beauty industry? Maybe not this year or next, but be prepared to see more and more Chinese brands start to hit the foreign market. Already, Herborist, a premium Chinese brand created 110 years ago in Shanghai, now has a strong Parisian following. It has subsequently built a three-floor flagship store and spa in the heart of Paris.

There’s also the possibility that Chinese tourists will rein in on buying up international brands when abroad as homegrown brands up their game. As the affluent Chinese tourist is a big spender, European brands should be aware of this potential shift in the future. However, only 6 percent of Chinese people currently own a passport and millions more are expected to travel abroad within the next few years. Remaining relevant to the Chinese tourist is a task that will prove lucrative.

The first ever SXSW London took over Shoreditch this month, offering a wealth of inspiration and insights across tech, business and culture. We share our thinking into how it can return even bigger and better for 2026.