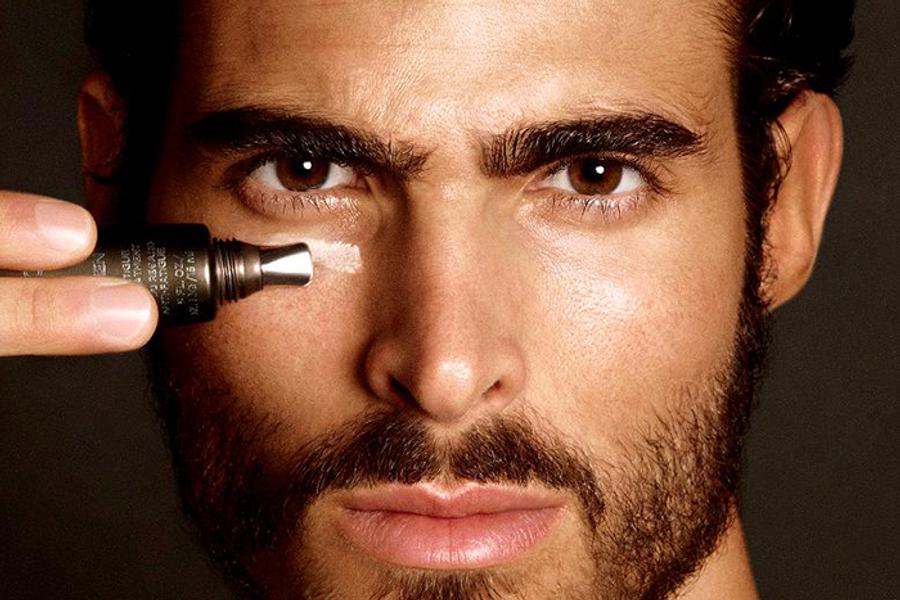

Beauty’s ‘Menaissance’

Beauty; an industry traditionally geared towards women yet men are spending more than ever on grooming and wellbeing. D&P explore the Menaissance era...

Beauty; an industry traditionally geared towards women yet men are spending more than ever on grooming and wellbeing. D&P explore the Menaissance era...

With consumers’ attitudes to masculinity in flux and men spending more than ever on grooming and wellbeing, we think the time is ripe for beauty brands to reassess what they’re offering male shoppers.

The beauty industry, perhaps more than any other, has traditionally been geared towards women. But as we explored beauty brand innovations for our ‘Beautiful Convergence’ report earlier this year, it became clear to us that this is changing. Male grooming salons and barbershops are flourishing, while dedicated ecommerce sites like The Motley and Mankind are curating the growing variety of men’s skincare brands – which extends as far as Tom Ford and Marc Jacobs’ men’s make-up lines.

The evidence is everywhere, not just in cosmopolitan cities. In the past six months two new barbers have popped up on my local high street, in a leafy town in Hertfordshire. One is a hipster-inspired space, the other a more traditional Turkish barber – an offering that was previously non-existent. The raft of beauty salons in this commuter town – synonymous with affluent stay-at-home mums – now have men’s luxury pamper packages on their treatment lists, demonstrating a shift in male spending habits outside of the capital.

Moving on from the 90s ‘metrosexual’ tag, grooming is no longer at odds with ‘masculinity’ and is increasingly viewed as a part of overall wellbeing and health. In fact the very notion of masculinity is blurring and diversifying (just look at Selfridges’ Agender concept, launched March 2015), especially among Millennials. According to Mintel, US sales for the men’s personal care market hit $4.1 billion in 2014, up 6.7% from 2012, and it predicts sales will grow to $4.6 billion by 2019.

The male groom boom is indicative of a far wider shift happening right across consumer-facing industries, from fashion (Verdict predicts the UK menswear market to grow 29.2% over the next five years), to groceries (51% of men are now the primary food shopper in US households, according to NPD Group), which is driving brands to rethink how they speak and cater to men.

Recent reports may suggest that the hipster beard trend has peaked, but Mintel’s study reveals that men are spending on a gamut of grooming services: 25% of those aged 18-34 have had a manicure or pedicure, and 38% a facial or body treatment. Smart brands are therefore creating holistic ‘man caves’ with just-for-him services and advice.

Here in London The Refinery offers laser hair removal, anti-ageing facials, massages, manicures and pedicures, plus retail products; Hackett and Liberty both house Murdoch-branded barbershops in store; Ted Baker has seven standalone Grooming Room locations across the city; and Aveda opened a men-only destination in September 2014, offering bespoke shaves, scalp massages, facials and nail maintenance ‘all from one chair’.

In LA, meanwhile, men’s hand and foot-grooming salon Hammer & Nails boosts dwell-time with personal TVs, complimentary drinks and a library of lifestyle books. And while not exclusively for men, London’s Barber & Parlour provides a blueprint for hybrid retail, with a barbershop, juice bar and cinema under one roof.

Considering that some men won’t be familiar or comfortable seeking grooming advice just yet, brands should also be sure to offer trusted expert advice – whether via in-store touchpoints, an associated app or online.

Convenience was a key trend in ‘Beautiful Convergence’, and highly streamlined, personalised formats such as monthly subscription boxes are equally as relevant for time-pressed professional men as women. Examples include Birchbox Man ($20/month – four deluxe samples custom-tailored to skin and hair type plus accessory), Dollar Shave Club ($1- $9/month for four cartridges plus razor handle) and Luxury Barber Box ($25.99/month for nine sample-size and one full-size product).

I also predict we’ll see a growing number of quick-fix, Uber-style apps that deliver more immediate and direct services. Launched in November 2014, New York app Shortcut lets users book out-of-hours barber appointments ‘on demand’ to their own home or workplace between 8am to midnight (from $75 a session).

While some use heritage to align grooming with traditional masculinity and opt for type-heavy, heraldic packaging (see Kiehl’s for Men, Triumph & Disaster and Baxter of California), the new wave of men’s skincare brands largely favour no-frills branding with clean lines and monochrome packaging – as if their performance credentials need little embellishment. One of the pioneers of this approach was UK label Bulldog, whose founder has said he wanted to stand out against the big brands’ ‘blue and brights’ packaging.

Men’s grooming brand No, where each product type is identified by a number rather than a name for easy step-by-step use, and Büro System both exemplify this new spirit simplicity, where masculinity is no longer something overt or forced, but open to interpretation.

Taking neutral branding a step further, unisex products are gaining ground among Millennials, in line with more nuanced, fluid gender attitudes. Look at Swedish skincare line Sachajuan, unisex fragrances from US perfumers Smoke Perfume and Le Labo, or the unisex anti-ageing moisturiser from luxury skincare brand TwinLuxe. In retail, House of Fraser’s website has a unisex filter in its beauty section, listing skin creams, serums and cleansing brushes. And with US haircare giant Redken selecting transgender model Lea T to front its global Chromatics campaign in 2014, once more we’re seeing the industry start to purvey a more inclusive message and overturn traditional, restrictive beauty ideals.

With ‘gender neutrality’ on one hand and dedicated ‘man caves’ on the other, it would seem beauty brands are at a crossroads, with two alternative pathways to pursue. As always, they’ll need to attune to which approach resonates with their specific target audience. But one thing is clear: beauty brands need to put men firmly on the agenda.

The first ever SXSW London took over Shoreditch this month, offering a wealth of inspiration and insights across tech, business and culture. We share our thinking into how it can return even bigger and better for 2026.